Most industries already use data to operate, advertise, and more, but there’s something about retail that enables better data evolution. Consumer data, especially with the rise of online shopping, is everywhere and savvy retailers and disruptors know just how to use it.

Retail data products are prime examples of successful growth hacking. Why? Because they’re able to evolve how data is used beyond the typical ways and easily adapt to new technology.

Successfully utilizing data

Reaching millions and millions of online shoppers returns an infinite amount of data. So brands and businesses use an array of analytics products to monitor sales, audience demographics, and the likes. But there are smarter ways to use the data.

Technology like virtual fitting rooms are deepening consumer analytics and changing investment patterns because of the insights and changes in customer experience. Data resources like RetailMeNot and eBates provide incentives (coupons and cash back) for shopping online. These sites work by affiliating with online shoppers and sellers through cookies and clicks. People already shop online so why not utilize the buyer journey? Data is endless and changes over time which is why retailers must adapt.

Disruptors and investors

Capturing data might be the simplest part of effective growth hacking. The hardest is transforming the data into new technology. Pain points are as endless as the data, but this means more disruptor and investor opportunity.

And that’s what brought life to TrueFit, a (well-funded)data-driven platform that addresses a major pain point of online shopping: figuring out if something fits without trying it on. TrueFit’s global empire now has over 100 million users and more than 10,000 brands maintained by complex AI and machine learning software. So how did they use data to disrupt the industry?

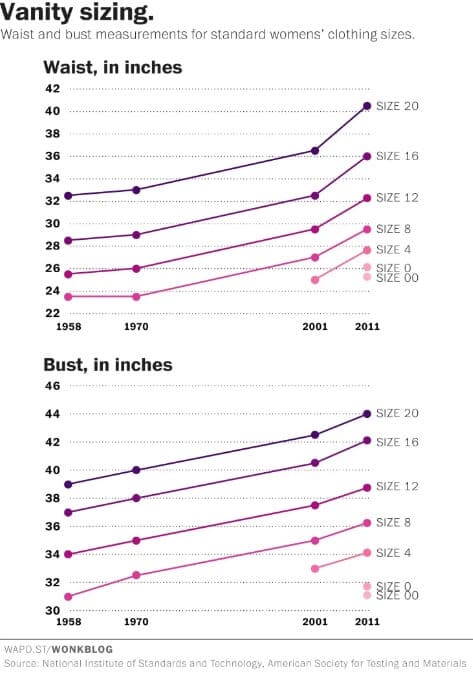

TrueFit simply built new data technology to address a huge pain point. By consolidating clothing measurements across brands. Modern vanity sizing has made it impossible to choose the same size from different stores. This was the data TrueFit used to grow the early stage of business.

It’s not just about the clothes

Using data products is more than just analytics or clothes. The effects are far-reaching at all levels of the industry and consumer behavior. A study revealed the average British woman will buy £22,140 (nearly $29,400) worth of clothing that goes unworn. That’s extra consumer money that could be used elsewhere and not so insightful product data points. Returns are a hassle for customers and a costly service for retailers. In 2017, about 10% of all purchases (or $351 billion, not including shipping) were returned. That mess less customer satisfaction and less revenue for business.

The retail industry stays ahead because brands and disruptors can build new products. The sheer abundance of customer data means endless insights we’re not acting on. So, take a look at your data and see what you’re not doing.