Technology trends are plenty nowadays. At any given time, there are new products and trends that are in every possible stage of the technology life cycle. And the burning question for investors, businesses, and consumers is “Is this valuable?” There’s no one way to identify value in tech trends, but you can follow the life cycle for better insight.

The anatomy of a trend

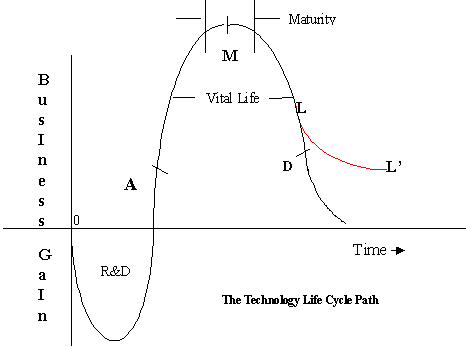

Technological trends tend to follow the typical S-curve. The curve illustrates the ideal path of success. The Research and Development stage is exactly what it sounds like, early efforts that don’t yield success or money. The Ascent yields monetary return and stability. When the product reaches Maturity, it’s reached its peak performance and gain. The Decline rate varies, but all trends will eventually come down from the peak. The decline can be small and plateau over time or lose all stability and take a nose dive.

Like anything we assign worth to, trends are only as powerful as we make them. A sudden interest can drive sales and maturity, but a lack of interest means less business. The most unpredictable element comes from the audience.

Like anything we assign worth to, trends are only as powerful as we make them. A sudden interest can drive sales and maturity, but a lack of interest means less business. The most unpredictable element comes from the audience.

Is it worth investing?

Some trends are a “right place at the right time” kind of deal, simply exploding with interest or unexpected applications at a random time. Like anything else, the ascent has to do with public reaction while long-term success will reflect true worth. Consider cryptocurrency, a fairly unknown trend that grew to explode in popularity in the past few years. Bitcoin was everywhere just a year ago when it reached maturity. The bitcoin craze has plateaued since its peak (at nearly $10,000) and for the time being, people can use it for transactions or sell like stock. However, because it has passed it’s maturity peak, Bitcoin prices are down from last year’s best.

Bitcoin continues to survive, but not without vehement critics that insist cryptocurrency is a sham. But there are hundreds of other cryptocurrencies that don’t amount to anything, and yet people still buy them. The hype is a bad indicator and shouldn’t be used as the only measure of success. If Bitcoin does happen to fall, what happens to everyone who invested? What are the applications that will ensure continued success? For all the tech that we regularly use today, there were countless others that were supplanted by better competition.

Success can still mean failure

Just because the money is good at one point doesn’t mean the trend won’t eventually fade away. There are a number of successes that, after peaking, couldn’t keep it up. Whether it was a marketing issue, refusing to change, or just obsoletion, products and companies have failed. Worth can be difficult to distinguish among the hysteria and big names. We usually expect successful corporations built on the cutting edge of innovation to think of cool new tech, but that isn’t always the case. Or sometimes the ones we think are close to the end keep holding on. The life cycle isn’t a one way street either, so you can’t expect a picture-perfect lifecycle. The tech landscape is always changing, but you can still use analysis to your advantage.